Posti Group Corporation is planning a listing on the Official List of Nasdaq Helsinki

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, DIRECTLY OR INDIRECTLY, IN OR INTO THE UNITED STATES, AUSTRALIA, CANADA, HONG KONG, JAPAN, NEW ZEALAND, SINGAPORE OR SOUTH AFRICA OR ANY OTHER JURISDICTION IN WHICH THE RELEASE, PUBLICATION OR DISTRIBUTION WOULD BE UNLAWFUL.

Posti Group Corporation is planning a listing on the Official List of Nasdaq Helsinki

Posti Group Corporation (“Posti” or the “Company”) announces that it is planning listing of its shares on the Official List of Nasdaq Helsinki Ltd. It is intended that in connection with the listing, the sole shareholder of the Company, the State of Finland, represented by the Ownership Steering Department of the Prime Minister’s Office, will offer shares it owns for purchase, and the Company will carry out a share issue to its personnel (the “Offering”).

Posti is one of the leading delivery and fulfillment companies operating in Finland, Sweden and the Baltic countries. Posti offers services in three business areas: Postal Services, eCommerce and Delivery Services, and Fulfillment and Logistics Services. Postal Services’ offering includes delivery services, multichannel services and digital services, which cover, among other things, letters (both corporate and consumer letters), multichannel messaging solutions, newspaper and magazine delivery as well as addressed direct marketing services in Finland. eCommerce and Delivery Services’ offering covers parcel delivery services and groupage freight services in Finland and parcel delivery services in the Baltic countries. Fulfillment and Logistics Services covers contract logistics and in-house logistics in Finland and Sweden as well as a single warehouse in Norway.

Information on the Offering

The objectives of the Offering are to expand Posti’s ownership base and enable the continued growth of Posti by improving its financial flexibility as a publicly listed company and strengthening recognition and awareness of Posti and its brand among investors, customers and other stakeholders.

The contemplated Offering is expected to consist of a share sale in which the sole shareholder of the Company, the State of Finland, represented by the Ownership Steering Department of the Prime Minister’s Office, will offer shares it owns for purchase (i) to private individuals and entities in Finland in a public offering and (ii) to institutional investors in Finland and, in accordance with applicable laws, internationally in an institutional offering. The institutional offering is expected to be made (i) in the United States only to persons reasonably believed by Managers (as defined below) to be qualified institutional buyers as defined in Rule 144A under the U.S. Securities Act of 1933, as amended (the “U.S. Securities Act”), or pursuant to other applicable exemptions from the registration requirements under the U.S. Securities Act, and (ii) outside the United States in offshore transactions in compliance with Regulation S under the U.S. Securities Act.

In addition, the contemplated Offering is expected to include a share issue by the Company to its personnel. The Company, the State of Finland, Posti’s Board of Directors and management as well as other members of the personnel participating in the contemplated personnel offering would commit to customary lock-up provisions. The State of Finland intends to remain the majority shareholder after the listing.

Antti Jääskeläinen, President and CEO, comments:

“Posti is a builder of a more functional society and an enabler of smoother everyday life for both consumers and businesses. We have several strengths and competitive advantages on which we build our future: our delivery network is comprehensive, our competitive position strong and our brand well known. One of our most important assets is our skilled and committed personnel. Our vision is to be an international, increasingly profitable delivery and fulfillment company. If completed, the listing would help us on this journey.”

Sanna Suvanto-Harsaae, Chair of the Board of Directors, comments:

“Posti has a clear direction and strategy. The development of the financial result has been strong for several years and profitability has improved. The company has succeeded in expanding its market area as well as improved its operational efficiency. Ready for the future, Posti is in good shape and ready for the potential listing.”

Maija Strandberg, Director General at the Government Ownership Steering Department of the Prime Minister’s Office, comments:

“The State’s responsible and long-term ownership policy supports Finland’s competitiveness, sustainable growth and stability through ownership. As an owner, the State must offer natural development paths to the companies it owns to support their growth. The sale of state-owned shares in connection with the contemplated listing has been carefully assessed and timed, and the State intends to remain the majority owner. We believe that the process would also have a stimulating effect on economic activity and social debate.

As an owner, we have analyzed the company and its readiness for listing, monitored market developments and assessed the timing from both the company’s and market’s perspective. Our aim is to create the best possible development path for the company while strengthening the State's finances. The contemplated listing of Posti and the additional dividend of EUR 150 million paid by the company earlier in January 2025 are part of the financial arrangements for the investment programme under the Government Programme.”

Posti in brief

Posti is one of the leading delivery and fulfillment companies operating in Finland, Sweden and the Baltic countries. Posti has three reportable segments: Postal Services, eCommerce and Delivery Services, and Fulfillment and Logistics Services. Postal Services’ offering includes delivery services, multichannel services and digital services, which cover, among other things, letters (both corporate and consumer letters), multichannel messaging solutions, newspaper and magazine delivery as well as addressed direct marketing services in Finland. eCommerce and Delivery Services’ offering covers parcel delivery services and groupage freight services in Finland and parcel delivery services in the Baltic countries. Fulfillment and Logistics Services covers contract logistics and in-house logistics in Finland and Sweden as well as a single warehouse in Norway. Even though Posti’s business is organized by business segments, it benefits significantly from cross-business unit synergies in its operations and sales. Approximately 60 percent of Posti’s 15,000 business customers buy services from more than one of Posti’s segments.

Posti has a diverse customer base consisting of private and public sector customers. Public sector customers include state agencies and municipalities. Private sector customers include private sector companies and consumers. Posti is the only operator in Finland designated by Finnish Transport and Communications Agency Traficom to carry out the universal service obligation designated postal services under the Postal Act. In addition to being the universal service obligation operator, Posti is the designated postal operator for Finland under the rules of the Universal Postal Union.

In 2024, Posti generated 82.4 percent of its net sales from Finland, 8.7 percent from Sweden, 2.8 percent from the Baltic countries and 6.1 percent from other countries[1]. At the end of 2024, Posti employed a total of approximately 15,000 people representing approximately 100 nationalities. This makes Posti one of the largest corporate employers in Finland.

Strengths

Posti believes that its key strengths and competitive advantages include:

- Strong and recognized brand

- Comprehensive network in Finland that creates synergies

- Market leader in Finland with a clear plan for future value creation

- Track record of strong performance and a policy of growing dividends

Strategy

Posti’s strategy centers around its strategic cornerstones:

- Growth – mainly organic, in addition to which Posti may consider potential selected mergers and acquisitions: Posti aims to drive growth in Fulfillment and Logistics Services, eCommerce and Delivery Services, as well as digital services through a unified customer acquisition model, offering and digital solutions. Posti may also consider possible acquisitions and transactions that could complement Posti’s existing operations and support the growth of Posti’s business in the future.

- Customer focused commercial excellence: Pricing and sales excellence to support the capitalization of strategic opportunities, and service development to achieve improved customer convenience.

- Preferred brand: Strengthening Posti’s brand preference by delivering consistently high-quality customer and employee experiences, and by enhancing brand visibility in all of Posti’s current markets.

- Sustainability frontrunner: Frontrunner in sustainability by executing Posti’s 2024–2026 sustainability program and green vehicle roadmap.

- Developing industry leading efficiency: Continuous improvement of operational efficiency through network optimization, technology capability development, and delivery model changes.

Financial targets and dividend policy

The Board of Directors of the Company has set the following financial targets in connection with the Offering. The financial targets are forward-looking statements and are no guarantees of future financial performance. All financial targets presented in this press release are solely targets and they do not constitute, and should not be treated as, forecasts or estimates of Posti’s financial performance in the future.

Posti has set the following mid-term financial targets for its operations:

- Average organic net sales growth (3–5-year period) of at least 2 per cent at group level and at least 5 percent outside Postal Services compared to 2025;

- Average adjusted operating result (adjusted EBIT) growth (3–5-year period) over 5 percent compared to 2025; and

- Net debt/adjusted EBITDA less than 2.5x.

According to its dividend policy, the Company targets paying continuously increasing ordinary dividends, and a payout ratio of at least 60 percent of net income.

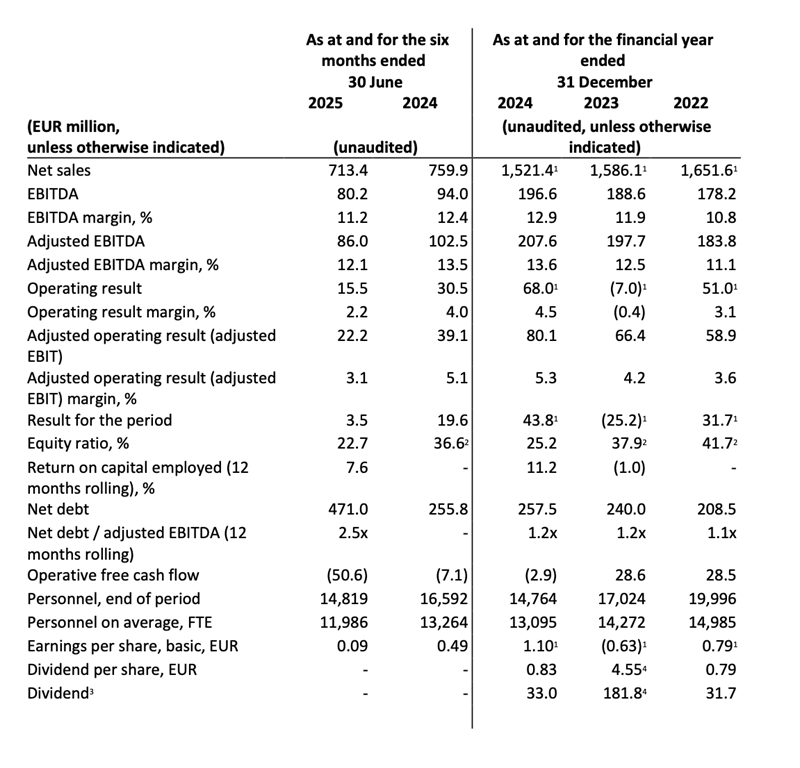

Posti’s key figures

The following table sets forth the key figures of Posti:

1 Audited.

2 Restated in respect of the treatment of terminal dues from other postal administrations. In its 2024 financial statements, Posti switched from gross to net presentation of terminal dues receivables and payables under the Convention of the Universal Postal Union, and the figures for the comparison periods have been restated accordingly. For more information on the restatement, see note 3 to the consolidated financial statements for the year ended 31 December 2024.

3 Dividend distributed for the financial year.

4 The ordinary dividend of EUR 31.8 million i.e., EUR 0.80 per share and extra dividend of EUR 150.0 million decided on 20 December 2024.

Prospects

Prospects are forward-looking statements concerning the Company’s view on possible development in its different markets. They are not guarantees of the development of the Company’s net sales or result or future financial performance. The result of the Company’s operations may differ materially from market development, and the Company’s forward-looking statements should not be considered as a promise of future performance or result, which may differ materially from those set forth below.

Posti is expecting its net sales in 2025 to be within the range of EUR 1,440-1,500 million, adjusted EBITDA to be within the range of EUR 192–205 million and adjusted EBIT to be within the range of EUR 65-77 million.

In 2024, Posti’s net sales were EUR 1,521.4 million, adjusted EBITDA was EUR 207.6 million and adjusted EBIT was EUR 80.1 million.

Current macroeconomic and market conditions increase uncertainty to economic projection and consumer confidence. Consumer behavior affects Posti’s business and may impact Posti’s actual results.

The Group’s business is characterized by seasonality. The net sales, adjusted EBITDA and adjusted EBIT in the segments are not accrued evenly over the year. In consumer parcels and Postal Services, the first and fourth quarters are typically strong, while the second and third quarters are weaker. The postal volume decline is expected to continue.

Advisers

DNB Carnegie Investment Bank AB, Finnish Branch and Danske Bank A/S, Finnish Branch have been appointed to act as joint global coordinators and joint bookrunners for the Offering (together the “Joint Global Coordinators”) and Nordea Bank Abp has been appointed to act as joint bookrunner for the Offering (together with the Joint Global Coordinators, the “Managers”). In addition, the Company has appointed Nordnet Bank AB to act as the subscription place in the public share sale and the personnel offering. Roschier, Attorneys Ltd. is acting as legal advisor to the Company. White & Case LLP is acting as legal advisor to the Joint Global Coordinators. Borenius Attorneys Ltd is acting as legal adviser to the State of Finland. Burson Finland Oy is acting as communications adviser to the Company.

Press conference

Posti will hold a press conference today, Friday 19 September 2025 at 11:00 a.m. at the Helsinki Stock Exchange at Fabianinkatu 14, FI-00100 Helsinki, Finland. At the event, Posti’s management will discuss the contemplated listing.

Media attending the event on site are kindly requested to register in advance by 10:30 a.m. at viestinta@posti.com.

The event can also be followed online at https://posti.videosync.fi/tiedotustilaisuus-19-09-2025.

For further information, please contact

Timo Karppinen, Chief Financial Officer, tel. +358 50 356 6405

Important information

This announcement is not being made in and copies of it may not be distributed or sent into the United States, Australia, Canada, Hong Kong, Japan, New Zealand, Singapore, South Africa or any other jurisdiction in which the distribution or release would be unlawful.

The securities referred to herein may not be sold in the United States absent registration or an exemption from registration under the U.S. Securities Act of 1933, as amended. The Company does not intend to register any of the securities in the United States or to conduct a public offering of the securities in the United States.

The issue, purchase or sale of securities in the Offering are subject to specific legal or regulatory restrictions in certain jurisdictions. The Company and the Managers assume no responsibility in the event there is a violation by any person of such restrictions.

This announcement is not an offer to sell or a solicitation of any offer to buy any securities issued by the Company in any jurisdiction where such offer or sale would be unlawful. The distribution of this announcement may be restricted by law in certain jurisdictions and persons into whose possession any document or other information referred to herein comes should inform themselves about and observe any such restriction. Any failure to comply with these restrictions may constitute a violation of the securities laws of any such jurisdiction.

In any EEA Member State other than Finland and in the United Kingdom, this announcement is only addressed to and is only directed at qualified investors in that Member State within the meaning of Regulation (EU) 2017/1129 (“Prospectus Regulation”) and Regulation (EU) 2017/1129 as it forms part of domestic law by virtue of the European Union (Withdrawal) Act 2018.

This announcement does not constitute an offer of securities to the public in the United Kingdom. No prospectus has been or will be approved in the United Kingdom in respect of the securities referred to herein. In the United Kingdom, this announcement is being distributed to and is directed only at persons (i) who have professional experience in matters relating to investments within the meaning of Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (as amended, the “Order”), (ii) who are high net worth entities falling within Article 49(2)(a) to (d) of the Order or (iii) to whom this announcement may otherwise lawfully be communicated (all such persons together being referred to as “Relevant Persons”). Any investment activity to which this announcement relates will only be available to, and will only be engaged with, Relevant Persons. Any person who is not a Relevant Person should not act or rely on this announcement or any of its contents.

Any potential offering of the securities referred to in this announcement will be made by means of a prospectus. This announcement is not a prospectus as set out in the Prospectus Regulation. Investors should not subscribe for or purchase any securities referred to in this announcement except on the basis of information contained in the aforementioned prospectus.

The information contained in this announcement is for background purposes only and does not purport to be full or complete. No reliance may be placed by any person for any purpose on the information contained in this announcement or its accuracy, fairness or completeness. The information in this announcement is subject to change.

This announcement is for information purposes only and under no circumstances shall constitute an offer or invitation, or form the basis for a decision, to invest in any securities of the Company. Each of the Managers is acting exclusively for the Company and the selling shareholder and no one else in connection with the Offering. They will not regard any other person as their respective clients in relation to the Offering and will not be responsible to any other person for providing the protections afforded to their respective clients, nor for providing advice in relation to the Offering, the contents of this announcement or any transaction, arrangement or other matter referred to herein.

The contents of this announcement have been prepared by, and are the sole responsibility of, the Company. None of the Managers or any of their respective directors, officers, employees, advisers or agents accepts any responsibility or liability whatsoever for or makes any representation or warranty, express or implied, as to the completeness, accuracy or truthfulness of the information in this announcement (or whether any information has been omitted from this announcement) or any other information relating to the Company, its subsidiaries or associated companies, whether written, oral or in a visual or electronic form, and howsoever transmitted or made available or for any loss howsoever arising from any use of this announcement or its contents or otherwise arising in connection therewith.

Forward-looking statements

Matters discussed in this announcement may constitute forward-looking statements. Forward-looking statements are statements that are not historical facts and may be identified by words such as “believe”, “expect”, “anticipate”, “intend”, “may”, “plan”, “estimate”, “will”, “should”, “could”, “aim” or “might”, or, in each case, their negative, or similar expressions. The forward-looking statements in this announcement are based upon various assumptions, many of which are based, in turn, upon further assumptions. Although the Company believes that the expectations reflected in these forward-looking statements are reasonable, it can give no assurances that they will materialize or prove to be correct. Because these forward-looking statements are based on assumptions or estimates and are subject to risks and uncertainties, the actual results or outcome could differ materially from those set out in the forward-looking statements as a result of many factors. The Company does not guarantee that the assumptions underlying the forward-looking statements in this announcement are free from errors nor does it accept any responsibility for the future accuracy of the opinions expressed in this announcement or any obligation to update or revise the statements in this announcement to reflect subsequent events or circumstances. Readers are advised to view the forward-looking statements contained in this announcement with caution. The forward-looking statements contained in this announcement are based on the views and assumptions of the Company’s management and the facts known by the Company’s management as at the date of the announcement and are subject to change without notice. The Company does not undertake any obligation to review, update, confirm or release publicly any forward-looking statements to reflect events that occur or circumstances that arise in relation to the content of this announcement.

Information to Distributors

Solely for the purposes of the product governance requirements contained within: (a) EU Directive 2014/65/EU on markets in financial instruments, as amended (“MiFID II”); (b) Articles 9 and 10 of Commission Delegated Directive (EU) 2017/593 supplementing MiFID II; and (c) local implementing measures (together the “MiFID II Product Governance Requirements”), and disclaiming all and any liability, whether arising in tort, contract or otherwise, which any “manufacturer” (for the purposes of the MiFID II Product Governance Requirements) may otherwise have with respect thereto, the shares have been subject to a product approval process, which has determined that the shares are: (i) compatible with an end target market of retail investors and investors who meet the criteria of professional clients and eligible counterparties, each as defined in MiFID II (the “Target Market Assessment”); and (ii) eligible for distribution through all distribution channels as are permitted by MiFID II. Notwithstanding the Target Market Assessment, distributors should note that: the price of the shares may decline and investors could lose all or part of their investment; the shares offer no guaranteed income and no capital protection; and an investment in the shares is compatible only with investors who do not need a guaranteed income or capital protection, who (either alone or in conjunction with an appropriate financial or other adviser) are capable of evaluating the merits and risks of such an investment and who have sufficient resources to be able to bear any losses that may result therefrom. The Target Market Assessment is without prejudice to the requirements of any contractual, legal or regulatory selling restrictions in relation to the Offering. For the avoidance of doubt, the Target Market Assessment does not constitute: (a) an assessment of suitability or appropriateness for the purposes of MiFID II; or (b) a recommendation to any investor or group of investors to invest in, or purchase, or take any other action whatsoever with respect to the shares. Each distributor is responsible for undertaking its own Target Market Assessment with respect to the shares and determining appropriate distribution channels.

[1] Determined by the geographical location of the Group’s external customer.